The Community Development Financial Institution CDFI Fund. In this guide we will go through the details of what journalizing means the different ways and types of journalizing transactions why theyre.

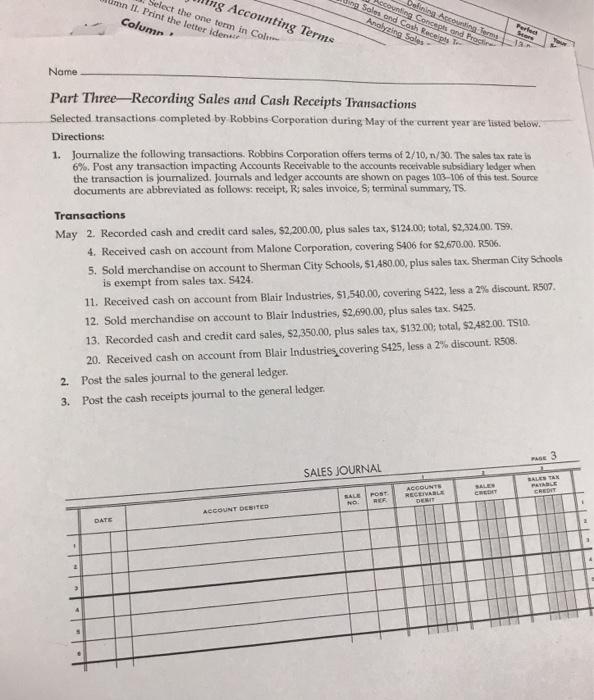

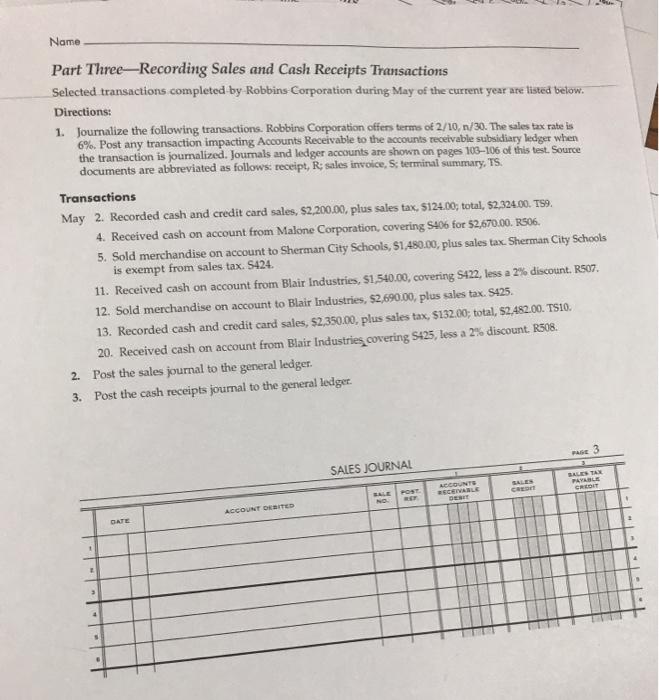

Solved Name Part Three Recording Sales And Cash Receipts Chegg Com

The process of preparing a batch report of credit card sales from a point-of-sale terminal.

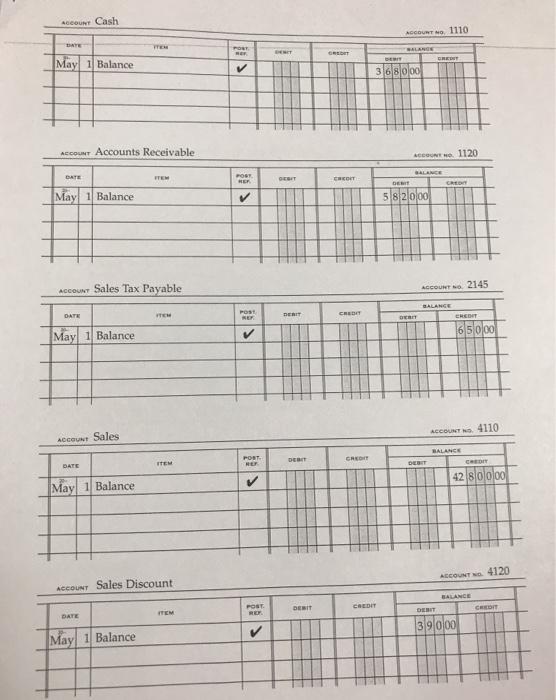

. The cash basis is easier than the. Small businesses prefer this method to track cash received and cash payments from the business. This recording is the building block for the business financial statements which are created at the end of the fiscal year.

Cash and Debt Forecasting. In accounting the terms sales and against expenses Fixed and Variable Costs Cost is something that can be classified in several ways depending on its. A sale in which a credit card is used for the total.

A cash discount on sales taken by a customer. They can record transactions whenever they accrue rather than when cash changes hands a method known as accrual accounting. Financial Stability Oversight Council.

The idea behind the accrual principle is that financial events are properly recognized by matching revenues Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. Incidentally that means youd have to go back. That includes items such as cash receipts interest received and income tax payments.

Credit allowed a customer for part of the sales price of merchandise that is not returned resulting in a decrease in the vendors accounts receivable. For tax reasons the cash basis of accounting is available only if a company has an average of less than 25 million over the prior three years in annual sales. Journalizing transactions is the process of recording and tracking any transaction that your business performs.

Solved Name Part Three Recording Sales And Cash Receipts Chegg Com

Solved Name Part Three Recording Sales And Cash Receipts Chegg Com

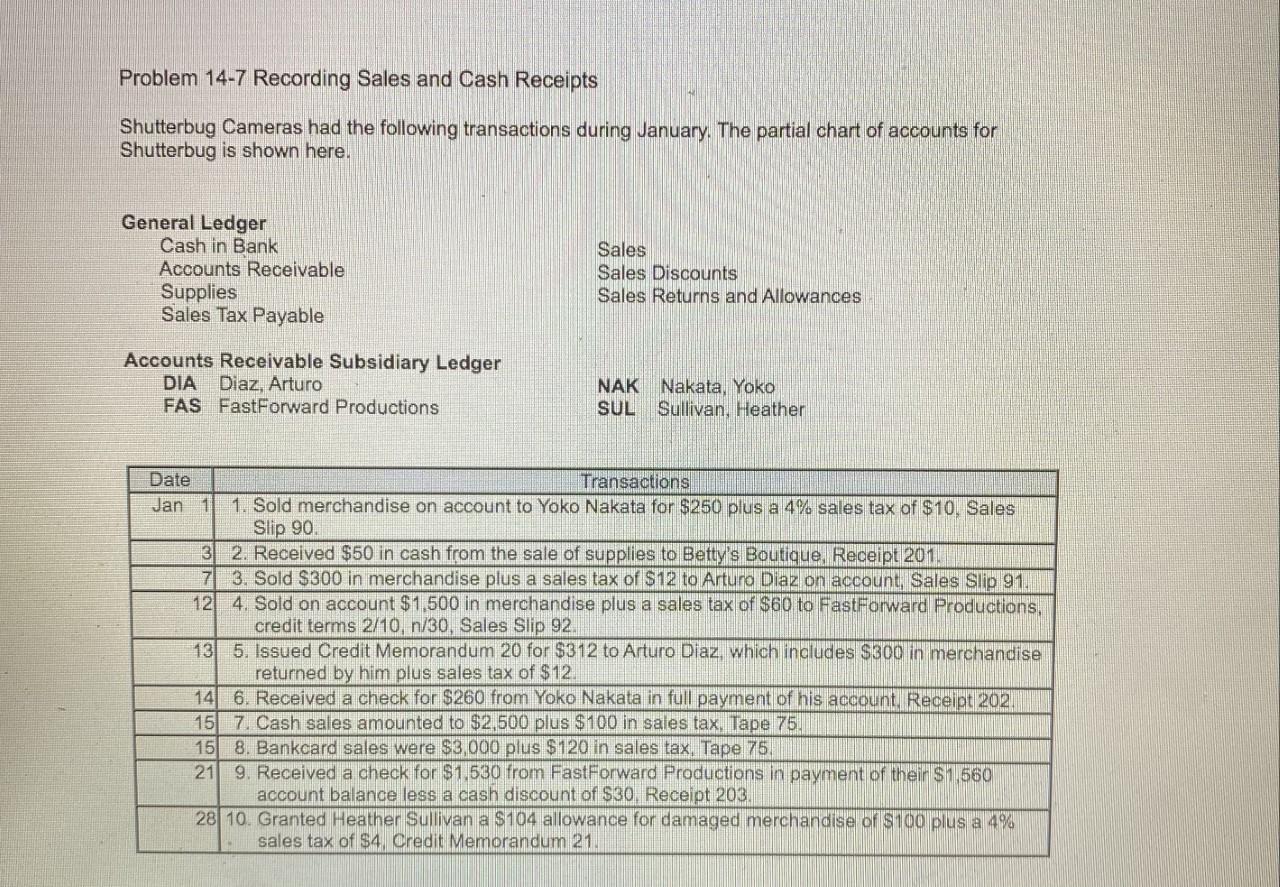

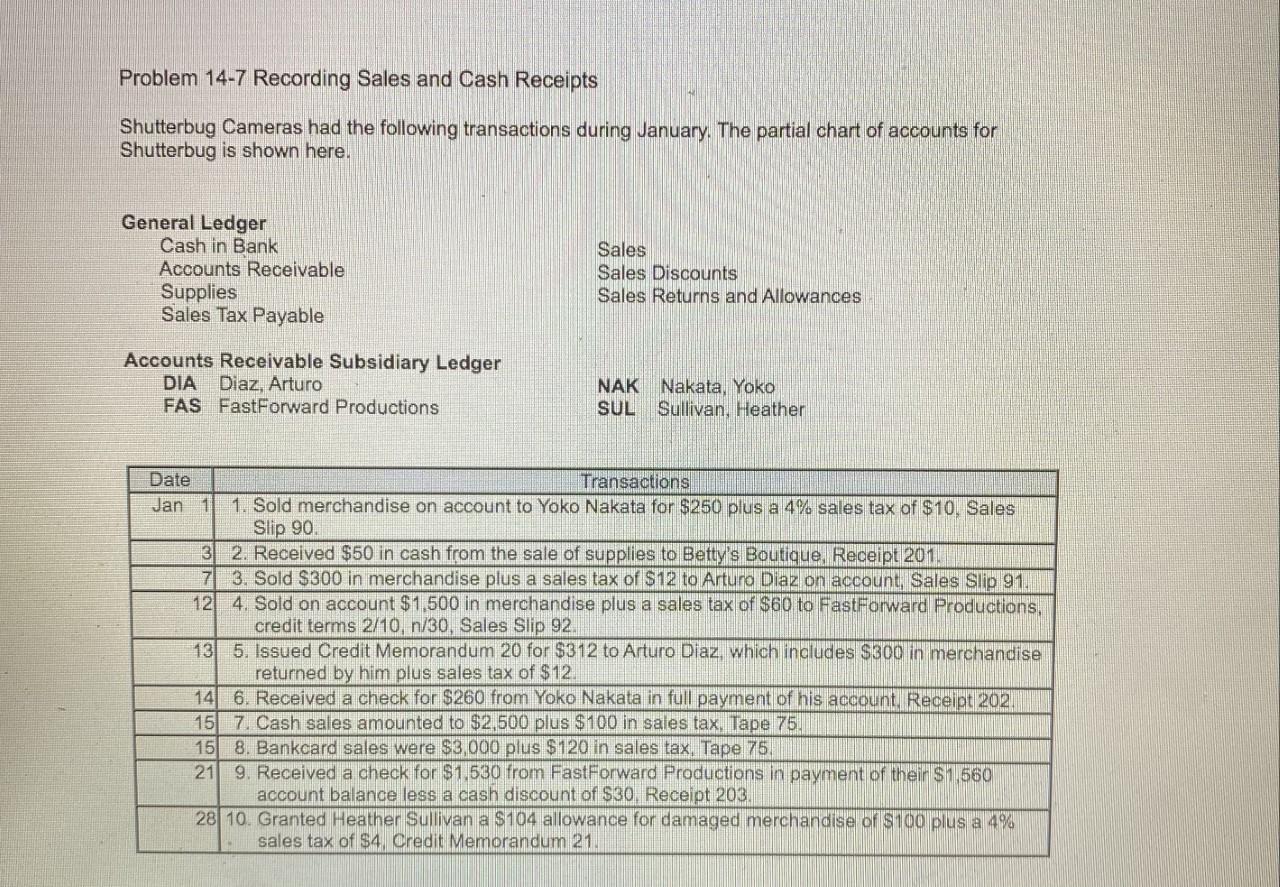

Solved Problem 14 7 Recording Sales And Cash Receipts Chegg Com

0 Comments